Is ADM a buy? AiQ shows commodity trends will be a tailwind.

In January, I published this article on the Easy Newz App blog outlining what “might have happened” at ADM. The reasoning was straightforward; the speed and vagueness of the announcement were foreshadowing. The speed indicated the company knew the problem, and most importantly, it was not systemic. The vagueness suggested it would make people look bad.

The options activity was another key clue. The Nutrition division responsible for the fiasco had experienced turnover. When the trades occurred, others, presumably outside the company, were trying to profit from oncoming write-downs.

I spoke with an industry executive who had worked on a deal with ADM’s Nutrition division a few years prior, “the valuations had made no sense then, let alone years later.”

It is up to the SEC to determine the punishment. These issues are mostly in the rearview mirror, barring a major SEC surprise.

Since the mea culpa (or lack thereof), ADM’s stock price is down 10%. Over the last year, it has fallen 17%, and the S&P Index has risen 29%.

ADM (blue) and the S&P Index (orange) performance for the past 12 months.

Is anyone talking about a developing bullish narrative?

Seeking Alpha published one pro-ADM article (link here). FYI, I did not pay the fee to read it. Otherwise, a potential rebound appears to still be under the radar. Here is a graphic from BarChart showing analyst recommendations since early Q2. It’s no surprise there’s been no movement. Equity analysts are rarely up to speed when fundamental shifts are happening in the commodity space.

Bloomberg buy/hold/sell rankings of ADM by month:

Jan '24: 50% buy / 50% hold

Feb '24: 5.9% buy / 88.2% hold / 5.9% sell

Mar '24: 12.5% buy / 81.3% hold / 6.3% sell

Apr '24: 12.5% buy / 81.3% hold / 6.3% sell

May '24: 6.3% buy / 87.5% hold / 6.3% sell

Jun '24: 7.1% buy / 85.7% hold / 7.1% sell

July '24: 0% buy / 91.7% hold / 8.3% sell

Is it time to get bullish on ADM?

Yes, ADM offers attractive risk/reward into 2025. Here is how I used AiQ’s proprietary modeling to identify fundamental trends.

Another approach is to “spread” ADM v Bunge for those concerned about buying equities with the S&P at all-time highs. Let’s walk through the fundamental commodity trends:

The US grain handle will be large. AiQ’s models have added more than 700 million bushels of production potential since mid-June, including the acreage increase reported on June 28 by the USDA. ADM’s optionality of processing (soybeans) and grinding (corn ethanol) versus exporting will provide additional flexibility. An integrated ADM is better positioned for a low-flat price, high-volume environment.

The outlook for ethanol margins is bright for the second half of 2024 and into 2025. In February, we began highlighting the historically hot, dry weather in Sao Paulo and surrounding areas while most marked sugarcane production higher and higher. The industry is coming full circle with whispers of cane production now under 600 million and total sugar production sub 40 million.

Brazil’s sugar production is at risk of significant markdowns from the optimistic outlook as recent as two months ago. AiQ began reporting on this in February, while other analysts kept marking production higher. AiQ’s models do not attempt to reflect fair price levels, but rather the impact of weather on plant growth and production.

AiQ’s models bounced to 605 on April 10, 2024 after the early April heavy rain event

Southern Sao Paulo and Parana received between 20 and 80 mm of rain over the last week. Don’t tell the traders; this is not the sugar production area.

During the first four months of the year, the daily average temperature in Sao Paulo was 3.6% above normal, and the average daily high was 4.5%. This was the warmest start to any year over the last four decades (presumably on record). Anyone who has worked with weather data understands how unreliable South American weather data can be.

According to AiQ’s proprietary ranking, this was the third-worst year for crop development since 1986. Only 2014 and 2021 were worse. These were also two of the most disappointing production years, driving bull markets for global sugar prices.

The precipitation and heat trends in Sao Paulo are very concerning. 2020 - 2024 were 5 of the worst 7 years for realized precipitation. The sugar production areas have stayed hot and dry since. Traders should watch closely for a trend change because central, western, and northern Brazil continue to trend dry and hotter than normal.

Production could disappoint in the months ahead. It would surprise the market if total production fell below 40 M. The early strong sugar mix implies tighter Brazilian ethanol supplies on the horizon. Although the mix, at just over 50%, will be less than analysts thought 30 days ago, it is historically high. This could open the door to more USA ethanol exports to the rest of the world and Brazil. One red flag is the Brazilian currency; FX weakness could limit the arbitrage for US ethanol entering Brazil (see chart above).

ADM v Bunge

Consider ADM’s stock price versus its largest direct competitor, Bunge. The blue line is ADM divided by Bunge, and the orange line is front-month soybean oil. We have highlighted Q1 2021 as the beginning of the renewable diesel investment boondoggle.

ADM/BG (Blue) & Soyoil (gold) before and after the investment boom began. Bunge is more exposed to BO prices.

Why do I use the word boondoggle? Companies were modeling >$2 per bushel board crush margins in perpetuity, assuming zero cost of capital for hedging and claiming minimal impact on the local soybean basis. It was pure fantasy, but the private equity and energy money did not care. Bunge announced its biofuel partnership with Chevron in February 2022.

The reality is beginning to set in for these investors. As Argentina ramps up, competition risks pushing margins below $1 per bushel.

There may be a global vegetable oil story brewing (due to poor softseed production). A bullish vegetable oil story is not necessarily good for US crushers. Why? The US could become a low-price, high-production island. Industry groups, such as NOPA, are pushing to restrict access for foreign-produced feedstocks to prevent this. Other origins, such as the EU, will see domestic processing margins stay strong into 2025.

High USA soybean oil prices are a double-edged sword because high soybean oil prices will support Argentina’s margins and pressure domestic demand. US soybean oil demand is very elastic in the current setup, and rich soyoil prices will hurt demand (even if the bulls continue to deny reality). Forward renewable diesel margins (2025) are poor, signaling that something needs to change. Traditional biodiesel producers are in an even worse spot.

This is a photo from LDC’s General Lagos facility south of Rosario in May 2024.

Argentina versus the USA

Another complicating factor will be the Argentina versus USA crush dynamic. Bunge will control two neighboring crush plants with over 50,000 metric tonnes of daily capacity. Bunge’s largest US crush plant is roughly 1/6 this size.

Due to slow farmer selling, Argentina's crush estimates for the year have fallen to as low as 38 million tonnes. Still, they could quickly ramp up to above 40 million if the FX issues are addressed and margins remain supportive.

Will Bunge fight for market share, running its Argentina assets at capacity or try to support domestic margins? It will be a difficult choice if both countries have large soy crops.

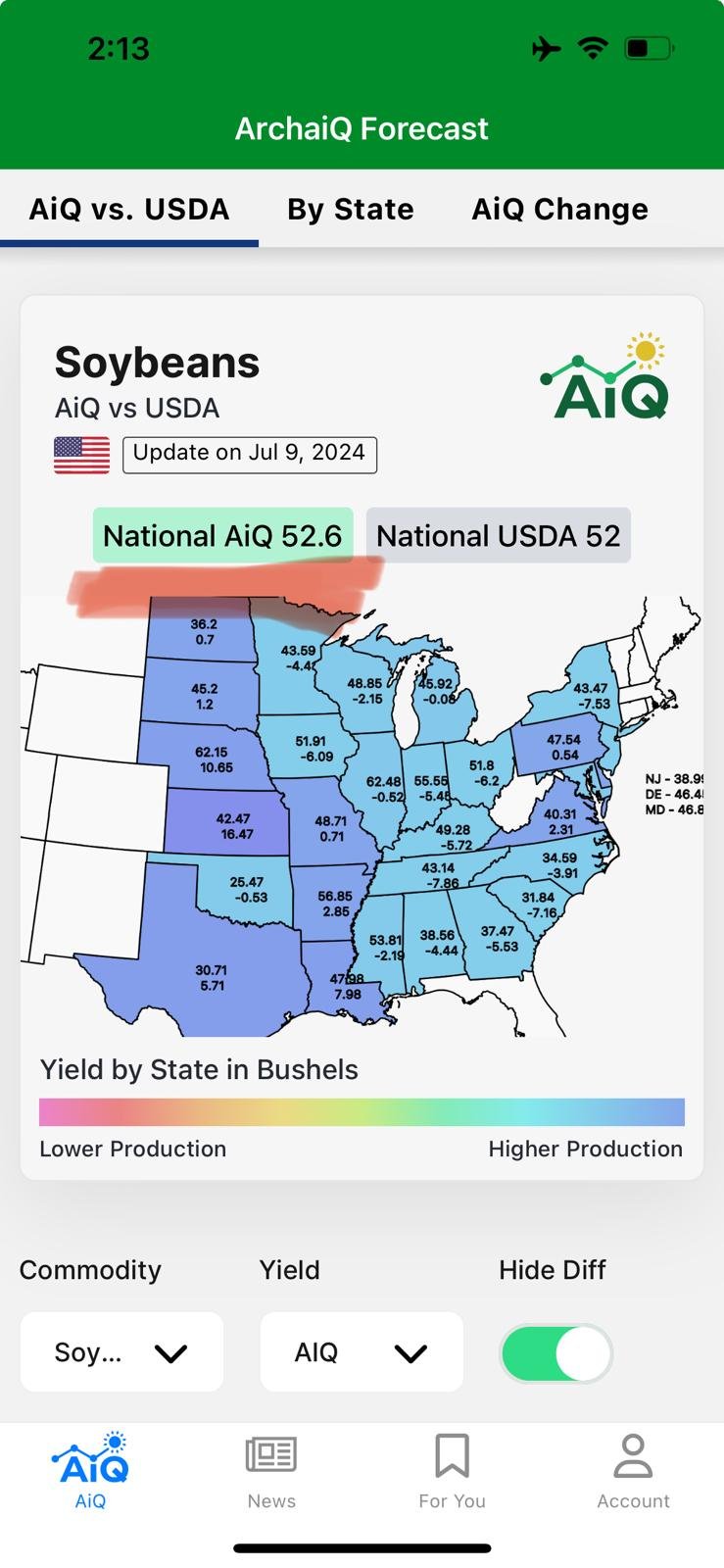

AiQ’s latest models are pushing above the trend of 52 (see below). As of this publication, July 10, there has been a lag due to STAR’s delayed satellite data release (June 23/week 25), so state-by-state production will see a jump. This is more impactful for corn. It’s still early for soybeans.

Get the app free at the following links (App Store) (Google Play)

The domestic soybean meal market has been strong even as crush rates set records. Traders have been waiting for a break in the front-end premiums to signal that cheap soybean meals will weigh on crush margins and provide a cheap alternative. If US soybean processing rates slow, lysine quickly becomes competitive in hog diets. ADM is the largest producer of lysine in the USA.

Technical Analysis Provides Simple Guidance

The uptrend will be broken at a close below $60. Similarly, a strong buy signal will initiate once prices close the gap. This provides straightforward risk/reward levels for investors to utilize a stop-loss and add risk. Similarly, if the ADM v Bunge price relationship moved back to its 5-year average of .75 (nominal figures), this implies ADM’s stock price will trade above $80 per share in the current environment.

A close below $60 will break the uptrend. A close above $68 confirms a breakout once price “closes the gap.”

ADM will release its second-quarter update on July 23, 2024. The excerpt from Q1 below shows that the executives have moved on, and the negative sentiment should as well.

Finding anything undervalued in today’s US agricultural sector is difficult. Low commodity prices and high land values will be challenging for the industry into 2025. ADM’s stock price might fall into this category (for now).

Full disclosure: This is not investment advice. I have not traded ADM stock and I do not intend to. This is purely an opinion piece with no inside knowledge of ADM or Bunge’s activities. Please do your own due diligence, and decide if the risk of investing is right for you.