Quiet Weather Part 1: Brazil Soybeans on Pace to be a Monster

Farmers in America are great, but so are the farmers in Brazil. They are tremendous at growing soybeans. Sometimes their government is not great at helping them grow soybeans, but they are big league growers. Don’t ever count them out.

-Something We Think Trump Would Say

Saying the Quiet Part Out Loud

Brazil is off to the best start ever. It will rain across northern Brazil, Center-West, and into Parana. Here are the two topics worth writing about.

The timing of rains in the south: from Rio Grande do Sul north into the southern half of Parana. If it gets dry, does this signal an earlier start to the dry season?

Safriña planting: will farmers on the margin push that last 2% of the area at lower prices? Has the currency done enough to offset costs? Can ongoing rains or an early dry season disrupt the planting window?

Sao Paulo will be a key state to monitor, it stays wet to start the new year.

We explained why newsletter writers were going to get sucked into bullish headlines again in our September South American Outlook.

Quiet markets in faraway places are a struggle for experts to generate clicks. The market ends up with papers like this.

Six weeks later, the dreaded La Niña-induced drought 😂😂😂

When large production areas like Brazilian soybeans get quiet, it suggests production potential is rising, sometimes beyond even the most optimistic guesses.

Let’s jump back to a year ago. These posts circulated across X. Every. Single. Day.

It began to rain in late December, but the noise continued until April, when the social media bulls finally gave in. The doom scenario never came to be. Most missed the Russian drought because they were fixated on a South American doom scenario that did not exist.

Two X Posts from Mato Grosso in January 2023

It is eerily quiet this year. Does this alone say something about the crop potential? Yes, we think so. Take a look at the searches trailing off in the last 30 days. It is an uninteresting topic at the moment.

How Big is Big for Brazil Soybeans?

The first problem is the data sources. There have been three separate sets of data. There are virtues for CONAB, the USDA, and boots-on-the-ground FAS attache updates.

The USDA provides aggregates at a national level, and the FAS seasonal updates are ad-hoc. CONAB provides reliably inaccurate updates.

Experts thousands of miles away are left guessing which data sources each season are best for aggregated guesses.

Methodology:

AiQ forecasts production at the state level for over a dozen of Brazil’s 21 soy-producing states. We account for smaller states and new production areas each week and reconcile model outputs to these known errors.

The goal is to narrow error margins quickly as the peak growing season approaches while providing transparency for humans to make fewer, better decisions.

AiQ will raise its soybean production outlook by 6 million tonnes to 178.250 Million. Brazil’s range shifts higher. Let’s take a look at what this means for yields.

The updated South American production range is unch due to higher yield potential in Brazil and reductions to Argentina. The AIQ prediction has moved materially higher as Brazil’s growing season is further along.

Should We Wait for the Crop Scouts to Confirm It?

We’ve repeatedly emphasized why surveys alone are an unreliable metric for predicting crop production or replicating USDA estimates.

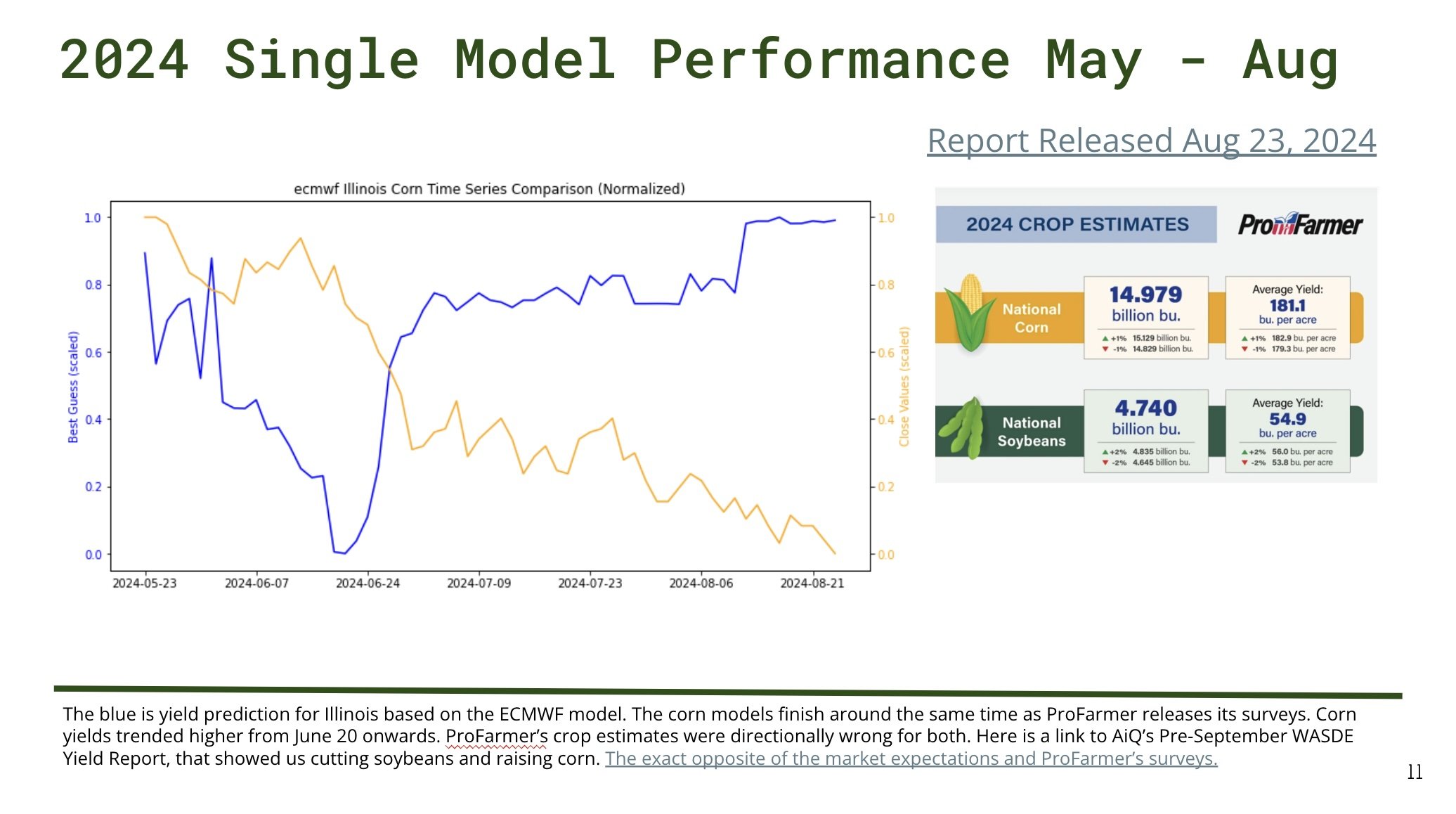

This slide showcases AiQ’s normalized production data alongside the annual ProFarmer survey for comparison. This was the ECMFW model from May to August.

Other than the line and pace, it was a fine putt.

Crop scouting is another outdated practice, but it can complement a robust research/data collection process.

By definition, a crop scout will scout crops, collect data, compile an analysis, and report findings. There may be insights into acreage or planting decisions, but it’s still just information after-the-fact.

Feb 20, 2023 crop scouts confirming, yields can’t be confirmed.

An impressive model in the early 2000s. These were the days when Plane tickets were expensive, weather stations were only coming online, and a Palm Pilot could be carried in place of pen and paper across recently-cleared areas of Mato Grosso.

The Blackberry would soon make the Palm Pilot obsolete, and Brazil would switch to 3G in 2007. This was high-tech reporting in those days.

The entire “real-time” production forecasting concept was as alien as ChatGPT.

The Rest of South America

Paraguay is in fantastic condition after a scorching hot spring. AiQ’s models show production potential between 10 and 12 million. The wide range is due to the recent forecast runs pushing dryness north. Typical weather the rest of the season could help yields above the 2019/20 record at 3.2 mt/ha (USDA 2.97 current).

Argentina’s off to a wonderful start, but the situation is more difficult for producers. Due to the strong currency and low prices, Argentina's farmers need big yields. Mother Nature is doing her best to cooperate.

Even as the forecasts have dried out, rains continue to pop up every few days. Northern Buenos Aires Province will be the key area to watch.

Will strong production (higher tax revenue) be another tailwind for President Milei’s surprisingly successful first year in office?

Weather forecasters will quickly talk up the “La Niña-like conditions.” This campaign has been nothing like the 2020-2022 triple-dip La Niña, but Sea-Surface Temps are falling below the critical 1-degree threshold (there appears to be some debate about this).

Last year’s corn losses came from Chicharitta (leafhoppers). The pests hit hard, hot areas in the north, even spreading into Cordoba. This year is the opposite. Here are the average temperatures since planting began.

Farmers in Cordoba will be mostly finished corn planting by Christmas. A much improved change from recent years.

The charts below showcase the latest forecasts through the first week of January. If temperatures stay mild and the region avoids prolonged, widespread drought, South America's weather markets are likely to remain quiet as we head into the new year. Quiet markets in early 2025 will signal big harvests ahead.