S. Am. Soybean Update as of Nov 29, 2023

Here is Easy Newz’s South American Soybean Production Update.

Total South America is forecast at 222.94, a decline of 9 million or 4% from our previous forecast of 232 mmt to start the campaign (October 1, 2023). All figures below are in million metric tonnes (mmt).

South America 222.94 (USDA 227.2)

Brazil 161.1 (USDA 163)

Argentina 44.65 (USDA 48)

Paraguay 10.07 (USDA 10)

Bolivia 3.87 (USDA 3.3)

Uruguay 3.25 (USDA 2.9)

Image courtesy of SLE Farms on X (link here)

Easy Newz background and explanation:

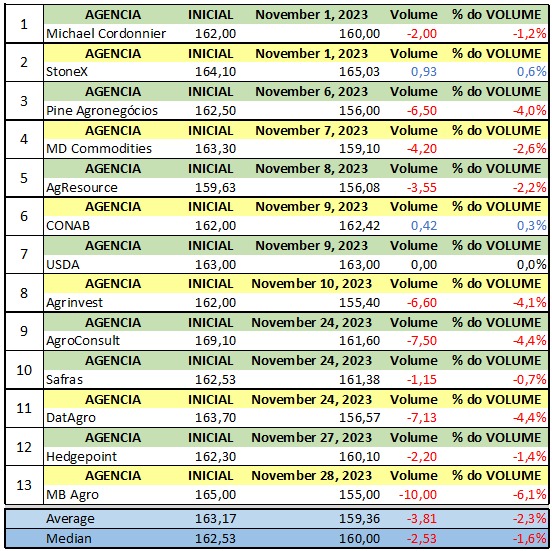

There is a trend of foreign crop analysts again starting too low in Brazil and moderating. Cordonnier and AgResource cut in early November. Both groups kept the numbers the same even as conditions in Brazil worsened, supporting our point that they started too low and cut too early.

There is still about another 5 to 8 million tonnes of cushion in the western hemisphere balance sheets before prices will have a function. This refers to when prices must be higher relative to competing crops to ensure enough acres are planted in other countries—or rationing demand via lower crush margins or substituting our soybean meal and oil.

Most Brazilian analysts are in the 156 to 164 mmt range today. December is when the weather really begins to matter. This is why we need more confidence in our second crop corn figures (coming out later), as acreage will be the wildcard. If it is hot, the beans could get harvested in time for more Safrina corn planting and less of an issue. No one knows today.

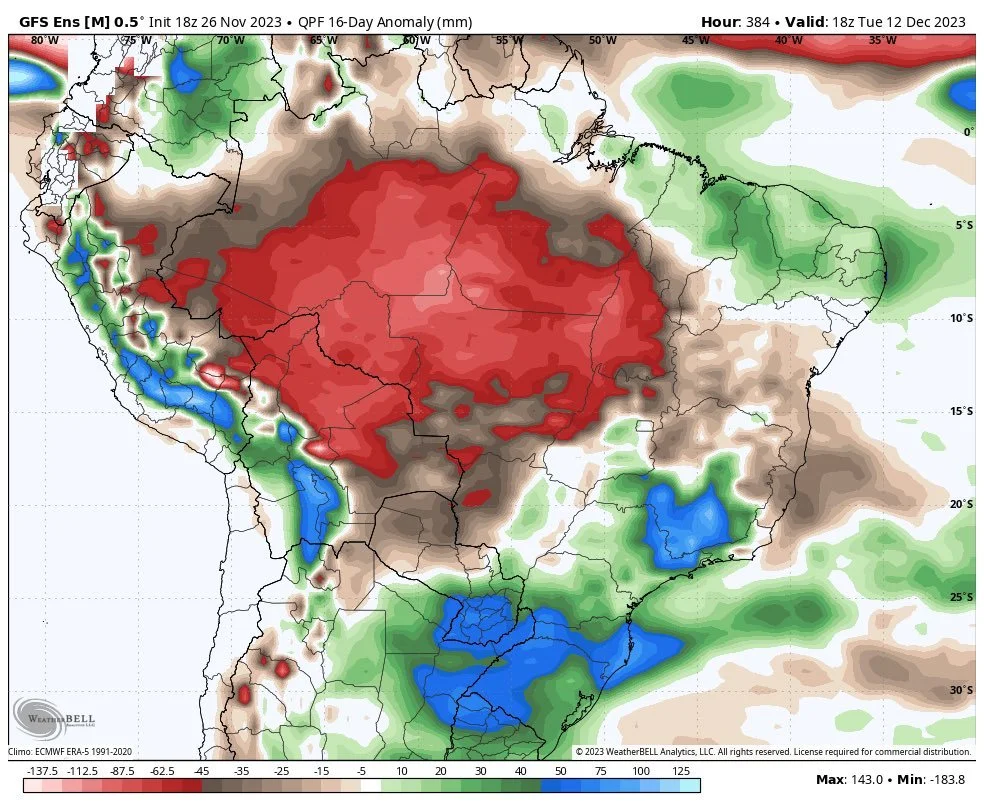

A map being circulated on X. A lot of red, but some areas do not grow many soybeans and some areas will still get greater than 2 inches of rain even if the 16-day anomaly is realized.

Brazil’s tropical areas get a lot of rain. The average precipitation in November is 170 mm or almost 7 in and 210 to 230 mm or 8 to 9 in during the main growing window. There is a world of difference between 70% of normal and 30% of normal. 30% is a problem, and 70% can still produce above-trend yields.

The recent scattered rains make it even more difficult to judge the impact, and it is rare for the north to be so dry this time of year. This is why few analog years are similar to the current growing season. Last June was a similar example when analysts erroneously compared it to other years.

This uncertainty is why we insist on relying on robust data and modeling early in the season. Human input helps judge potential acreage shifts and how input availability or changes in pricing might influence last-minute farmer decision-making.

Humans rarely judge production impact well without robust data sets and modeling due to recency bias and herd mentality.

Issues in the modeling are identifiable and quantifiable. A current example is the influence of satellite-driven inputs in Argentina without a fully sewn crop. Satellite data can lag, which may weigh on production with better rains in the latest model runs. Our personal bias could be higher production potential for Argentina.

Two other examples where human input can help early in the season are farmers switching to cotton in Mato Grosso and Argentina’s farmers struggling to source fertilizer for second-crop corn. The upside potential is considerable if rains in Argentina are realized and significant switching occurs. This will begin to show up in December production numbers.

We expressly caution against looking at maps with a lot of red and concluding the crops are being irreparably damaged. Brazil gets a lot of rain, and technology adoption in Brazil has been game-changing.

Farmers using Easy Newz can rest assured they are receiving the best information with no agenda

Questions or thoughts are welcome. Our goal is education, not generating social media clicks!