2025 Weather Risks Jump for Brazil & Argentina

Argentina

The immediate issue is expanding dryness in Argentina’s main production area. These are sometimes referred to as the Pampas or Nucleo Zone. This includes Cordoba, Santa Fe, Western Entre Rios, and Northern Buenos Aires Province.

Other areas are dry, but production is not significant enough to offset a problem in these provinces. Southeast Buenos Aires is in very good shape, and temperatures have remained cool.

Dec 4 - 13 corn outputs fell on average 8% to 12% after a great start.

AiQ updates its official production figures every Wednesday, but its models provide daily outputs based on the latest forecasts.

AiQ cut its soybean production from the start of the season at 55.8 to 52 million as of last Wednesday, and corn fell 1 million to 50.

Sometimes you have to be more specific with ANDY. He gets better daily.

What is unique about ANDY is he can break down heat stress relative to drought conditions, while also talking about second-order impacts such as disease pressures.

Others try to imply that a single variable will have a specific impact, “50% normal precip means -.13 mt/ha,” as if temperatures and realized weather season-to-date does not matter.

If we could only grow crops with a single weather variable.

Brazil

The dryness that began in eastern Argentina pushed drought risk into Brazil to start the New Year. Rio Grande do Sul through central Parana has not received much rain since early December.

This area is predominantly full-season corn and soybeans, which are higher-yielding and at risk of more significant losses.

The issues in southern Brazil are similar to those in Argentina, with comparable production at a risk of 15-25%.

To provide some context for this risk scenario: In mid-December, projections for output ranged as high as 21 million tons, assuming typical weather conditions in January and February. However, current estimates now place the lower end near 15 million tons. AiQ had identified this Brazilian state as the highest risk in its September preview (referenced here).

Mato Grosso do Sul received below-average rains the last two weeks, but it’s too early to get excited. More concerning is eastern Paraguay, which received a large storm in early December and not much since.

There is Too Wet Brazil to Talk About

Center-West Brazil (the largest production area) and the northern states continue to experience an extremely wet summer. Since mid-October, this is the % of precipitation versus normal in millimeters:

Mato Grosso 191% (767 v 402)

Sao Paulo 294% (607 v 207)

MGDS 223% (460 v 206)

Minas Girais 240% (721 v 301)

By mid-January, the late harvest/closing planting window for Safriña talk will increase. If prices are rallying, it will become a major topic. The planting window has expanded because of how quickly farmers can plant, but the same high-price incentive is not there as in recent years to push the window too far. AiQ’s total corn is projected at 126M for Brazil.

One Note of Caution

Friday’s sell-off was NOT weather-related. The story for the agriculture markets over the next 4 weeks IS all about weather. There will be talk of tariffs—which will have a much greater impact on soybeans. Soybeans do not have the same story (yet).

Global grain balance sheets are tightening. Friday’s WASDE just got much more interesting.

These are the numbers everyone will be watching on January 10, 2025

From October until the end of December, a weather story was lacking to kickstart a rally. It did not matter how hard the Clickbait Crowd tried to create one…

Here’s what’s changed.

The GFS first dried out in late November. This led to output cuts from Nov 27 until Dec 4, and the Euro saw cuts of a similar magnitude from December 3 until 13. The GFS dryness spread, and after a week of a possible shift back to the wetter ECMWF, it again took over. The potential of record yields was reduced by over 10%.

How did we know to lean toward the GFS outputs?

Others talk about “weighted averages,” AiQ points out the locations and forecasts that matter.

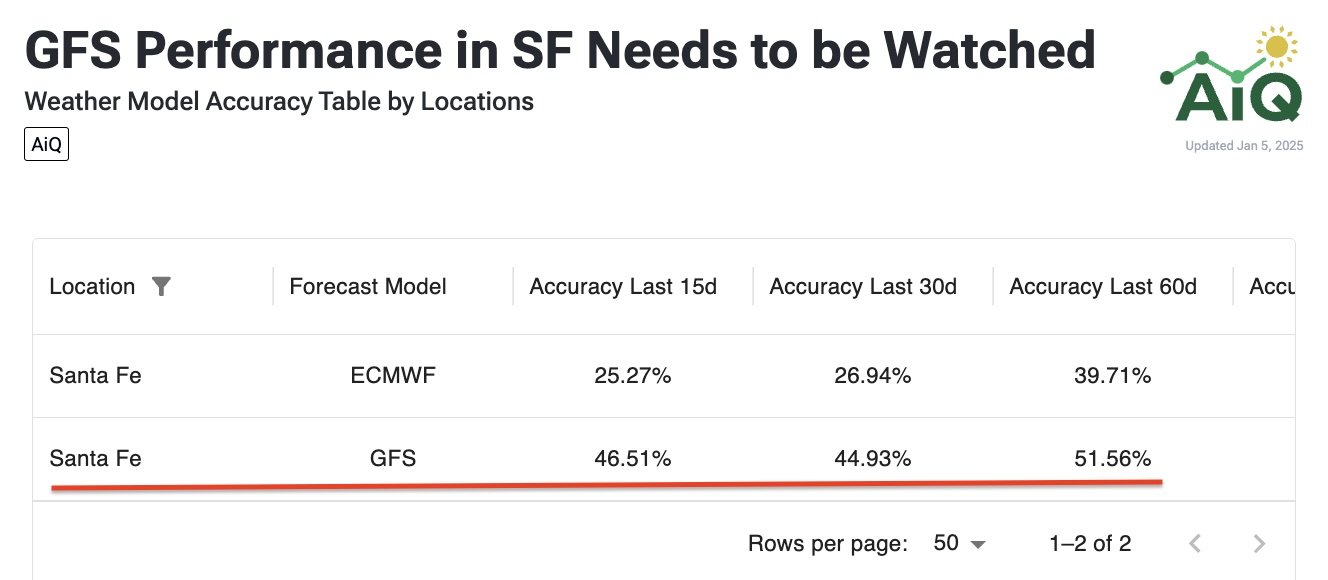

AiQ’s Weather Forecast Accuracy Tool

The image above shows how much better the GFS has performed over the last two weeks. Why not just talk about “Argentina?” Why is Santa Fe more important to watch than generic Argentina maps?

Santa Fe is a critical state to watch because it is ground zero for where the drought began and spread. It is also home to the second-largest grain port in the world. The logistics disruptions will increase, and most have assumed the crush will reach 44 to 45 million tonnes for the upcoming campaign.

Argentina’s farmers are praying for the reduction of retentions (export taxes) or a devaluation as they watch growers in Brazil benefit from the record-weak Reais. This might have had much more to do with Friday’s sell-off…

Friday’s sell-off may prove a gift to buyers.

The same one we talked about three months ago as the weather problems went away.

Keep a close eye on the heat because there has been very little this season before January 1, 2025.

ArchaiQ (AiQ) is a partner of Easy Newz. This is not trading or investment advice. Trading Futures is high-risk; please consult with a professional. AiQ receives input from partners and experts worldwide, whose opinions may be reflected in the figures above.