“The only rule for Ag Twitter Recap: If you don’t share it, we will probably miss it” -Easy Newz

9 February 2024

This is agriculture in February. No one is ever happy.

This is not tech, VC, or PE. Stay off the podcasts when you are laying off employees. Even if it is agtech, it’s tone-deaf. Let’s try to be better than that. Indigo to date: 11 rounds of funding for $1.4 billion source: Crunchbase (NewMoon nails it)

You do not want your customers feeling both unheard and sometimes not even considered.

This is where we are in the soybean cycle of despair: “It’s bullish,” “it’s not going anywhere,” “it’s so bearish, it’s maybe time to be bullish.”

We hope the rains arrive in time @agrosurvivor in Santa Fe. Here is why you need to be skeptical on social media. These farms are less than 200 km apart, and the one on the left is more expensive land that should outperform in an El Niño year.

The S Am weather concerns are legitimate; it won’t be enough in the short term to overcome negative sentiment as the WASDE pushed back on CONAB. There may be more bearishness ahead because the USDA appears focused on the demand side, and the acreage pie is not shrinking. Soybeans are winning acres, and global grain stocks might have turned a corner. It’s too early to get bullish.

At least one commodity is out there trying: Cocoa

The confectionary butter/powder made new all-time highs less than 48 hours from the first post. I never thought I could hope for Harmattan Winds (let’s make it educational too).

Who’s going to tell them?

“They cited inherent flaws in the government programme, including a lack of supply management. The failure of the living wage scheme to boost or even protect farmer incomes is a blow to global efforts to make the production of chocolate bars more ethically sound after years of promises to purge the industry of child labour, poverty and rampant deforestation.”

The fundamentals of cocoa are extremely dislocated. Disease, dry dust winds, smuggling (absolutely unknown supply dynamics), lack of investment for YEARS prior, and confectionary companies that will now fight for market share. This is a situation where the exchange may need to step in.

Fun Fact: inflation-adjusted all-time high for cocoa is more like $25,000. Calling tops will be tempting… (Data BLS Website)

Call of the Week (a chart crime was committed)

Thanks, Darin, for catching this one. “Cheap or Expensive is up to the buyer or seller.”

“Ags are NOT cheap.” Someone created a very busy chart seemingly drawing causation from correlation (a ratio???). The chart only goes back 4 years!!!! Are you kidding me?

Speaking of hindsight. There is a circle around “Russia invaded Ukraine” in the chart below. Here is a Bloomberg article about Daleep Singh, one of two architects of Russian sanctions. He is candid about the inability to anticipate the knock-down effects on oil and agricultural commodities.

A farmer will be forced to sell crops and run out of money long before ags have any function versus equities (or any other unrelated market, for that matter).

This is bad advice, but sexy social media fodder. These are what we call chart crimes. Yes, we understand that normal chart crimes refer to the misleading axis, cherry-picked dates, etc.

Let’s be better: Farmers blaming farmers is not a solution

-Comparable land in Argentina is $5,000, Uruguay $8,500, Brazil $11,000, and the USA $15,000+++ (top of my head!)

-Farmers in Brazil are tearing up the Cerrado (not rainforest), and it is quite similar to what the US did to its plains in the 1920s after the government set wheat prices.

-The US turns farmland into developments and other infrastructure because it is worth more (full stop). Domestic commodity prices should be supported due to the expansion of SAF, Renewable diesel, etc, if this is happening.

-Unfortunately, the combination of recent government policies (Tariffs) and weather (Panama Canal/Mississippi River) has opened the door for others to gain market share. Australia backed off its COVID-19 origin claims and is AGAIN shipping huge exports to China. Do we really think… that they think… that the origin changed? 🧐🧐🧐

When farmers in the USA struggle, they do in most other places too. Argentina’s farmers have been struggling for 2-3 years, and farmers in Brazil are next. We don’t blame farmers. We are here to support all of them.

All farmers supporting other farmers… Yes, even the French and English ones

As a quick aside, there will be 64 elections held worldwide. The obvious prediction: many more farmers Protests ahead

Live Cattle are so back!!!

In case you missed it…

Indigo, FBN, and Farmer’s Edge made it longer than Bill Northey, Toby Keith, and Dave Brandt. Some things just make you wonder… We wish their friends and family all the best.

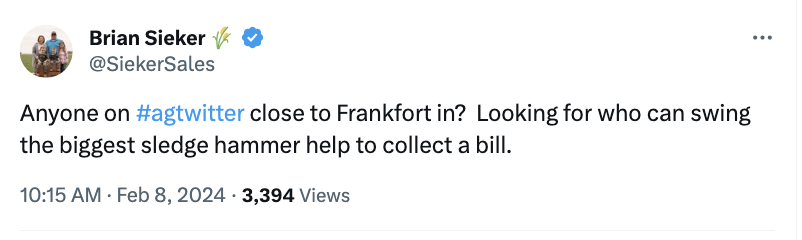

Ag Twitter is always here to help. Everything it lacks in expertise or remedial training, it makes up for in effort.

Need more of this energy, please share any cool met-in-real-life stories

This is the story of CAR DEALERSHIP GUY. Be sure to check this out.

Parler and $7 corn were the good ole days. Who feels old?

FYI, we thought we could keep it to one rule for Ag Twitter Recap, but there is a second: no alibis, bail, or character witness testimony.

This folks is why we can’t have nice things!

Update: Brian got his money. Rumor has it he lost it all trading wheat shortly after 🤷♂️

We are witnessing the birth of a great idea. Thank you John & Colin. After this, we will keep the humblebrags to LinkedIn.

And that, my friends, is how we saved Ag Twitter!

See you next week.

Weekly Recaps